How to Fund and Grow Your Emergency Fund

Fund and grow your emergency fund so it can save you thousands of dollars.

And if you don’t have an emergency fund or money set aside, you’re one bad day away from going into DEBT.

Plus, let’s keep it real, shit happens!

And depending on what that shit is, you can be 1 accident away from being in massive debt.

But when you need it most, your emergency fund will save you.

It’s money set aside that’ll ease your mind. Could save your life. And stop you from having to pull out that credit card.

Or worse, begging friends and family for money.

In the past, I’ve used my emergency fund:

- To pay my bills after leaving the Air Force

- Replace a $1,200 refrigerator that died

- Hire someone to fix my dryer when it broke

- For unexpected car maintenance

- Other items that broke at my house

And yes, you might not have the same emergencies I had.

But you will have an emergency someday. This is why you should fund and grow your emergency fund.

Note: Don’t invest your emergency fund or buy random stuff with it.

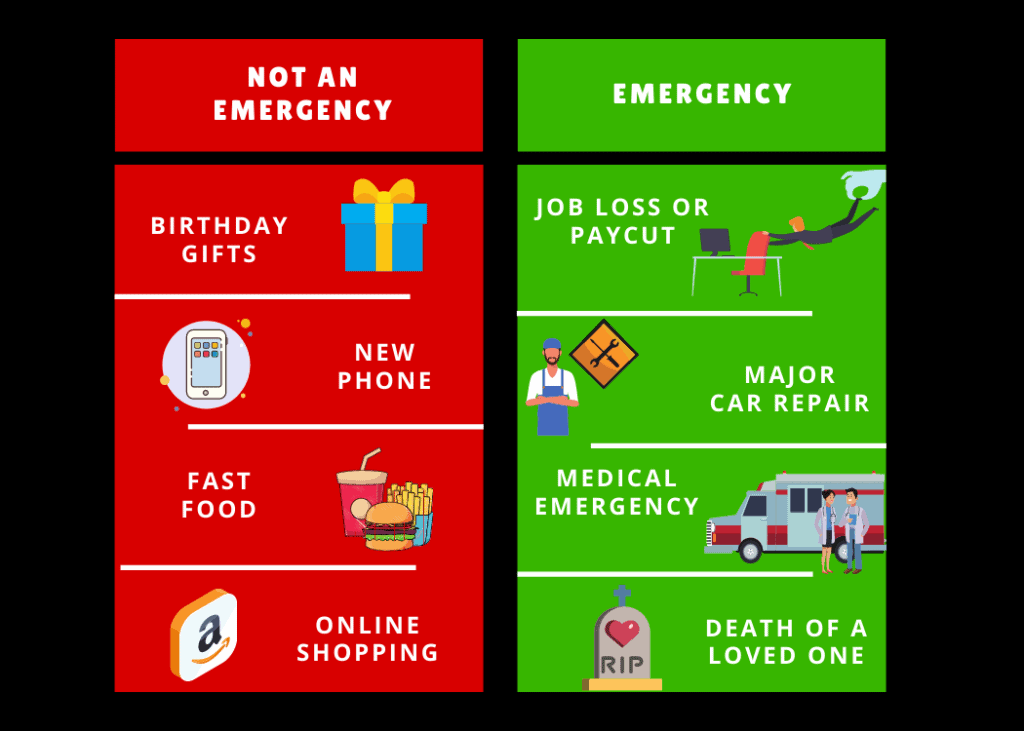

The money you’ve saved and set aside is for EMERGENCIES ONLY. If you invest it or buy stuff you don’t need it won’t be there for you when you really do have an emergency.

Like an unforeseen medical bill because you needed an ambulance ride to the hospital.

A trip in the back of an ambulance can cost you hundreds of dollars. And I’d hate having to pay all of that on a credit card.

Ooh-wee!

And sure, saving money for an emergency might be boring. But you need to be prepared.

So here are five ways to grow and fund your emergency fund.

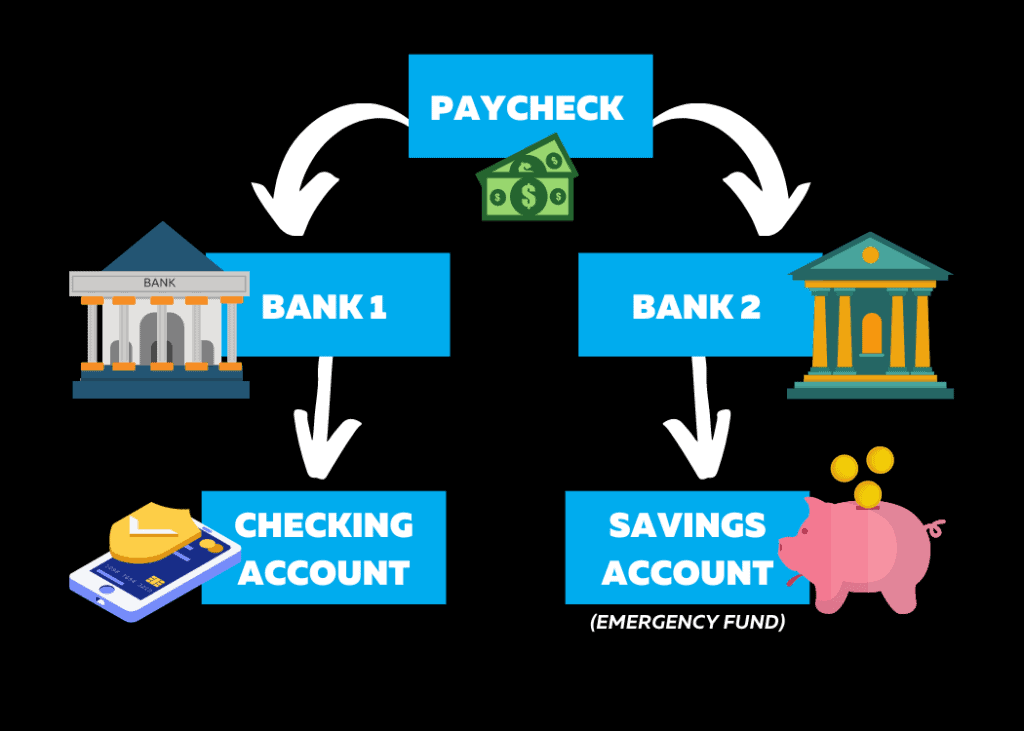

1. Keep Money in Your Emergency Fund Separate

Treat your emergency fund as a business.

Separate it from your personal bank accounts.

Don’t put the money you’re setting aside for it in your main checking account. Because you shouldn’t be using the money you’re trying to save to buy food and pay other bills.

You might spend it without even knowing.

Or think it’s money you can spend because it’s available and sitting in your account. Which is NOT the case.

Unless you have a true emergency.

So, if I were you, I’d open up a bank account at two different banks.

Use one bank account for your everyday spending. And the other bank account (preferably a savings or “money market” account) to hold your emergency fund.

A savings or money market account will earn you a small amount of interest on your money. While keeping your emergency fund separate from your main spending account.

But, when in need and you DO have a real emergency, the money in your account can be easily accessed.

2. Save Six Months to One Year of Living Expenses

Many people would normally recommend saving three to six months of money in your emergency fund.

But life can get expensive. This is why I think you need to fund and grow it even more than that. Besides, it’s better to be prepared and have a larger emergency fund than a smaller one.

You don’t know how long you’ll need to live off of your emergency fund.

So, let’s run the numbers.

If you normally spend $3,000 per month on bills (rent, food, utilities, etc.) you should fund and grow your emergency fund to $18,000 or $36,000.

Yea, I know that’s a lot of money to many of us out there.

But, start small and work your way up. It might take you a few years but it’ll grow. And in time, you’ll reach your goal.

Besides, the time’s going to pass anyway. Build your emergency fund!

- $18,000 will get you through six months

- $36,000 will cover all your bills for an entire year while you figure things out

Emergencies and events out of your control can and do happen. But, proper planning and preparation prevent poor pockets.

3. Live Below Your Means, Temporarily

I get it, most of us don’t have it.

Saving and growing your emergency fund to $18,000+ isn’t going to happen overnight.

And if you’re hardly getting by or have nothing set aside right now, just start. Even if it’s $5.

Find ways to cut back and save as much as possible. At least until you hit your six-month emergency fund goal.

Every day log into your accounts and look at your money.

Figure out and find ways to save. Ask yourself, do I really need that (fast food, thing, or item you were going to spend money on)?

More than likely it’ll be a want and not a NEED. And when you reduce or eliminate your wants, save that money you would’ve spent in your emergency fund.

Because saving, funding, and growing your emergency fund takes time. And that’s 100% okay.

Saving for any big expense can take a while. So will saving for your emergency fund.

Be patient.

And just do it. It’s a marathon and not a sprint.

Move at your own speed.

4. Make a Commitment to Fund and Grow Your Emergency Fund

What we focus on and track grows.

So focus and track your money. Save as much as you can for that rainy day fund.

Shit, stop

Please Note: This isn’t forever. Just until you have at least a few thousand or one months worth of money in your emergency fund.

Having an emergency fund and something to prevent you from going into debt is more important than investing. Or paying off debt in the meantime.

Why?

Because if you have an emergency or unexpected medical problem, they can create new and massive debt.

So, commit.

And don’t stop saving and putting aside money for your emergency fund until you’ve maxed it out.

5. Put It On Auto-Pilot

Let’s be honest. Most of us aren’t going to set aside money daily, weekly, bi-weekly, or monthly.

This is why making it automatic will fund and grow your emergency fund faster. And when you make it automatic, it’s one less thing you have to think about doing.

Run the numbers and figure out how much money you’re going to commit on a regular basis.

Then either have your bank or employer do it.

A little paperwork or a few clicks will automatically create a habit for you.

And boom, you’ll have recurring weekly, bi-weekly, or monthly transfers doing the rest of the work for you.

Just set it, and forget it. It’s that easy.

My Final Thoughts

There are tons of articles talking about how broke the average American and individuals are.

Don’t be an average, broke individual.

Fund and grow your emergency fund. Even if it’s only $1,000.

Who likes being broke? Or begging friends and family for money.

Because I don’t know about you, but I HATE begging other people for money. I’m too prideful.

And whether you like it or not things will break. You will get sick. And you might even lose your job.

But be prepared, and have an emergency fund.

And if you don’t have one set up and going already, start yesterday. Or now!