Top 3 Budgeting Strategies and How to Budget the Smart Way

Budgeting is often associated with being cheap, sacrificing too much, or not enjoying your life.

However, budgeting is quite the opposite.

It helps you spend more money on your passions, projects, and desired lifestyle. And knowing exactly where your money is going monthly gives you valuable insights into how you’re spending.

Today, I will explore the three popular budgeting strategies proven to work.

But, before getting into the three budgeting strategies, let’s review some key things to help you identify where most of your money is going.

Understanding The Budgeting Process

First, before creating your budget, various categories need to be explored to fully understand the overall goal of your budget.

A budget cannot and will NOT make you rich overnight!

It can teach you proper money management techniques to solve even the most serious financial problems.

And, once you learn how to manage a small amount of money, you’re more likely to succeed when making more money.

But, let’s go over a few things before you create a budget of your own:

Debt and Credit Cards

You may have heard good credit is important, but you might not know why.

Credit is debt. You can us purchase assets, which can increase your wealth faster than if you didn’t have good credit to use.

Debt and credit are what leverage is all about.

Leverage is the use of borrowed money for (an investment), expecting the profits made from that investment will be greater than the interest paid. Many wealthy individuals use leverage to increase their holdings exponentially.

The most common example of how a good credit score and debt can make you richer is by obtaining a mortgage.

On a $300,000.00 mortgage loan:

- Someone with a 5% rate for 30 years will pay $279,767.00 in interest on the loan

- Versus, someone with a 3% rate for 30 years will pay $155,332.00 in interest on the loan

The difference is huge, and the difference is much worse if the loan amounts are higher. The general rule for increasing your credit score is understanding the factors that play into it.

And without telling you a bunch of details right now, your credit score is not only determined by paying your loans on time but by the amount of credit available to you.

Therefore, repairing your credit can be done faster by:

- Increasing your credit limit

- Paying off high-interest debts first (credit cards are usually around 20% interest rate)

- Obtaining more debt products, like personal loans and credit cards, and not necessarily using them

Discretionary Spending

In our budgeting strategies below, one of the biggest aspects of creating a budget is keeping track of your discretionary spending.

Discretionary spending is an expense or costs a person can survive without if needed. Other examples of discretionary spending include:

- Movies

- Expensive Liquor

- Designer Clothing

- Unnecessary Subscriptions

While tracking your discretionary spending is normally done monthly, those in an extremely difficult financial situation should review their spending weekly or even daily.

Regularly checking your credit card or bank account will show you exactly how much you spend in certain categories.

The tap-to-pay option on your credit card wasn’t made for convenience, as banks want you to believe. It was created so you can pay faster, which makes people less mentally worried about how much they’re spending.

If you’re unsure of your spending habits, try only buying items using cash for the next few weeks. You should notice a difference in your spending immediately.

The mistake most of us make when creating a budget is completely cutting out our discretionary spending on entertainment and restaurants. If you’re eating out 3-4 times a week, switch to only once a week.

Budgeting Goals

While “saving more money” is a great goal, it’s not realistic.

Most people abandon their new year’s resolutions, not due to laziness but because of a lack of defining what they’re working towards. For example, a popular goal is to lose more weight.

A more effective plan is “lose 10 pounds”. The best version of this goal is “I want to lose 10 pounds in 4 months by walking more daily”.

Once you have a goal, defined a successful outcome, and a method to achieve it, it’ll likely happen.

Make your budgeting goals S.M.A.R.T.:

- Specific: I want to save an additional $500 per month.

- Measurable: Every week, I’ll see if I’m on track to retain an extra $500 on the final day of this current month.

- Attainable: I can reach this goal if I control my entertainment-related spending this weekend.

- Realistic: With my current

income and potential reduction ofexpenses , this is realistic. - Timely: I will achieve this goal in 3 months and maintain and improve upon it.

Stay motivated, celebrate your wins, and reaffirm WHY you’re budgeting. In the above example, a common goal is for someone to save a few extra hundred a month towards a specific goal.

A life-changing goal you want to accomplish bad can motivate you. For example, a house, car, boat, or much-needed appliance.

Why We Need Simple Budgeting Strategies

Most of us don’t like to use spreadsheets unless we love numbers.

While forcing yourself to use spreadsheets can sometimes work, balancing discipline with passion and simplicity is the best way to keep on track while budgeting.

And even if Excel’s a great tool, it doesn’t need elaborate columns and pie charts for your spending habits.

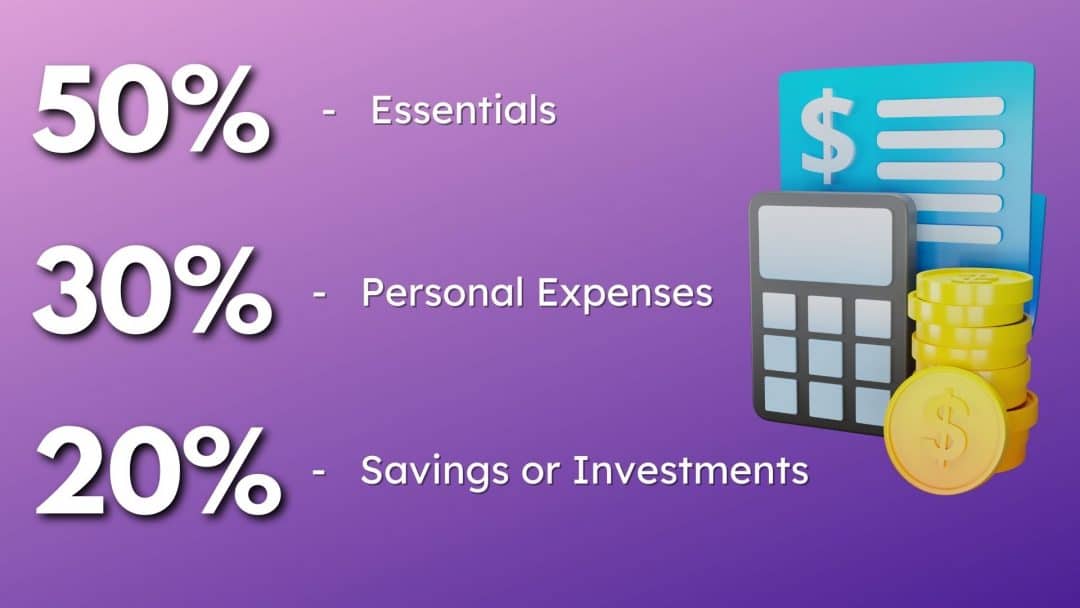

Strategy #1: The 50/30/20 Budgeting Strategy

The 50/30/20 rule is a guideline for your spending.

This budgeting method is an effective budgeting strategy for grouping categories together. That way, you can see how much of your after-tax

The ratio will be different for each of us based on our life circumstances and goals. But here’s how it works:

50% Goes to Essentials

Essentials are categorized as things you need to live.

These are different for many people, depending on your living situation. The largest contributing factor is your shelter. If you’re living at home with your parents or splitting costs with others, this category can usually be further downsized to save more aggressively.

But, for those who rent at a high cost of living or have the burden of home ownership – this can sometimes exceed 50%.

I think it’s best to fit all your food, housing, and household bills related to your living

30% Goes to Personal Expenses

Personal

These items can benefit you physically, like purchasing skin-care products, personal items, and some cosmetic devices.

It can also benefit you, such as discretionary spending, which I discussed above. This includes a night out with friends, eating out, food delivery, purchasing activities and shows, and much more.

Your Essential and Personal

20% Saved or Invested

If you’re in a position to create a budget and have found this article, this might mean you’re making more than minimum wage to survive.

But, if you find yourself in a bad financial position due to a lack of

If you’re currently making more than your

You can adjust it as needed, but saving and

It can even be used to retire on top of your employer plan.

For example, if your take-home pay is $3,000 a month, saving 20% for 30 years will yield a portfolio value of over $1,200,000 when invested in an S&P 500 index (assuming an average return of 10% compounded annually).

Strategy #2: The Zero-Based Category Budget Strategy

A category-based budgeting approach is common and one of the most popular budgeting methods.

But, I think it’s hard to stay motivated using this strategy. Why?

Because many people find spreadsheets and columns boring, there are other ways to approach this method.

A “zero” approach to the category-based system means every dollar is accounted for. The goal is to have extra at the end of each month.

And you can use that extra money towards another category. Often, this can mean

There are also apps designed specifically for this budgeting strategy:

- Mint

- Everydollar

- Y.N.A.B. (You Need a Budget)

You can also make it fun for yourself.

If you’ve adopted the method of spending only cash when necessary, you can create a “tip jar” for yourself each month and fill it with the required amount.

At the end of the month, withdraw anything that’s left over and do what you’d like with it.

Strategy #3: The Pay Yourself First Budgeting Strategy

Paying yourself first is perhaps the simplest and most aggressive budgeting technique you have at your disposal.

It requires no tracking, just a general sense of your lifestyle.

This works best for those who do not have the time to keep track, have an extremely lofty goal, or want to challenge themselves by limiting their ability to make poor decisions.

Warren Buffet also talks about it in his famous quote, “Do not save what’s left after spending, spend what’s left after saving.”

This notion is simple but can be dangerous if not done correctly.

You lock the money into a savings account or, even more effectively, an investment account. An investment account will usually yield more in the long term, and the money is more difficult to liquidate and withdraw.

Once your paycheck hits your account, set up an automatic contribution or alert to immediately put the money away. Once invested, you’ll have to find a way to live on less than you make.

And it’s as easy as that!

Start with what you can manage for now and work your way up. You can also invest as much as you want for a goal and learn to live on the rest.

But, make sure you also cut back on your discretionary spending.

Like entertainment, eating out, and unnecessary purchases instead of your essentials like housing, food, and transportation.

Sticking to a Budget in a High-Inflationary Environment

Due to the recent price increases and inflation, many of us will find it more difficult to save money.

While cutting down on our

In this situation, as I stated earlier, the best way to stick to a budget is to increase your

This can be through a raise, getting more education to shift careers, or identifying an opportunity for side hustle

If you’re living in the United States, you have the following options available:

- Uber

- Shipt

- Instacart

- GrubHub

- DoorDash

And many more side-hustles you can try.

Just know your

Good luck! And try things out as you work on figuring out which budgeting strategy works best for you.

Here’s How I Budget

I like to budget by using the Pay Yourself First Budgeting strategy I’ve mentioned above.

Paying myself first is my favorite budgeting strategy as it allows me to save and invest my money before touching and spending it.

Whenever I get paid, I automatically invest as much as I stomach. I use this budgeting method because I’ve tried zero-based budgeting in the past, and it just doesn’t work how I want it to.

But if there’s something I want to save up for, I will use a zero-based budget until I reach my goal on top of paying myself first.

Paying myself first allows me to spend on the things I want and enjoy without tracking every expense or wondering if I’m hitting my saving and